When will the stock market crash? Everyone would like to know the answer to that question!

Large Contract (SP) Data No Longer Available

On 30 September 2021 the large S&P500 contract (symbol: SP) ceased trading. The Stock Market Crash Indicator featured in this video and article is based on this contract. As a consequence the indicator and stock market crash signal unfortunately no longer work.

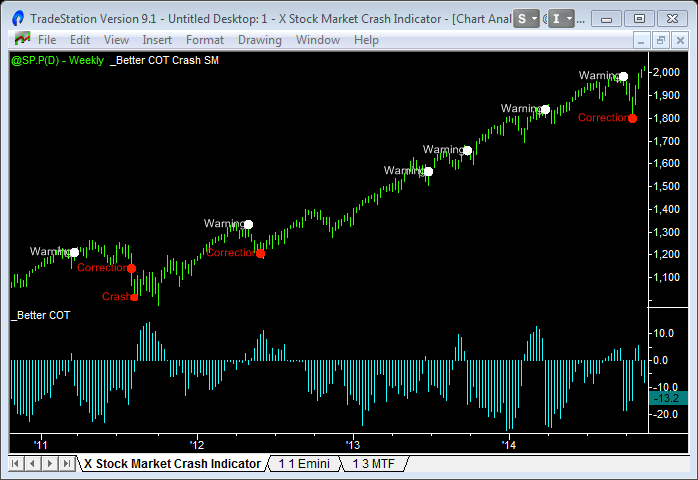

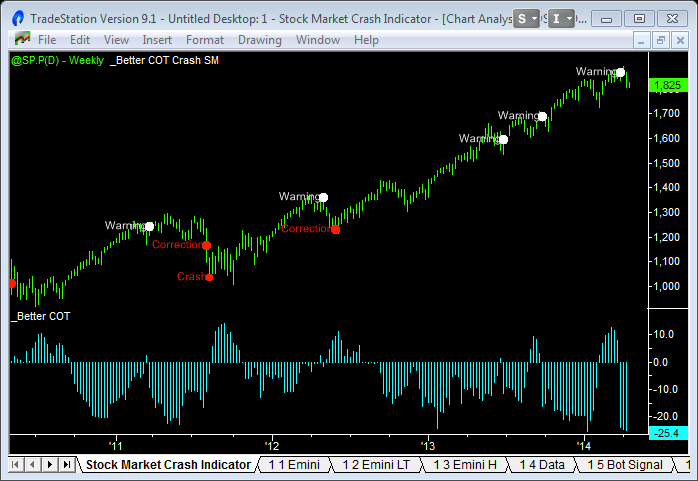

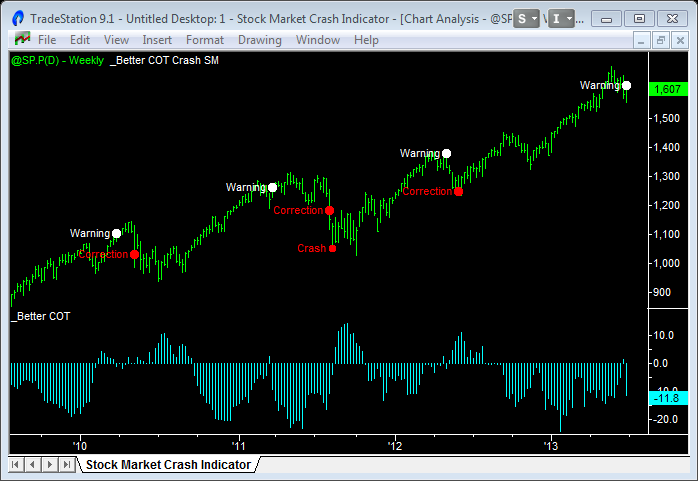

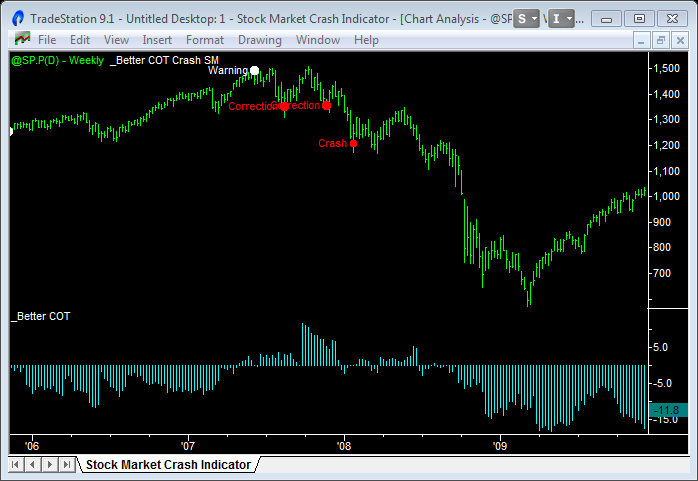

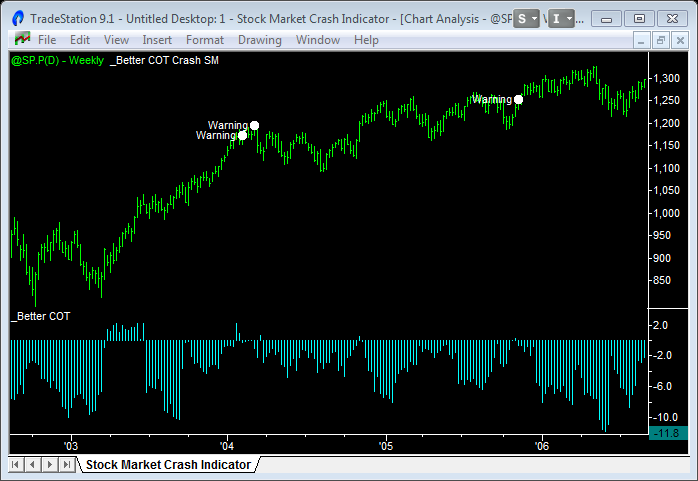

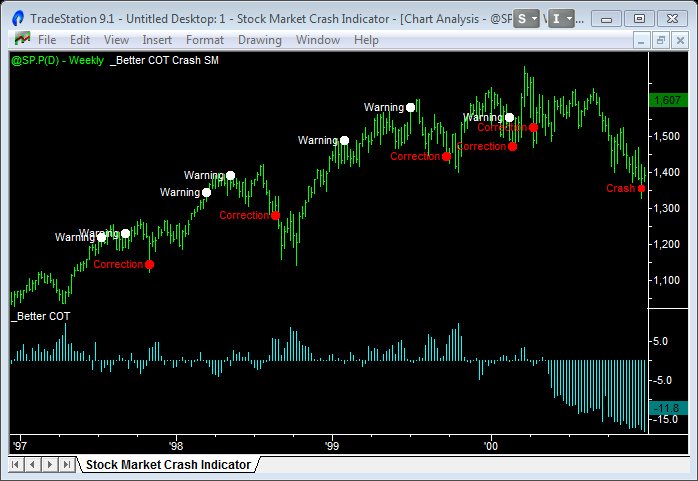

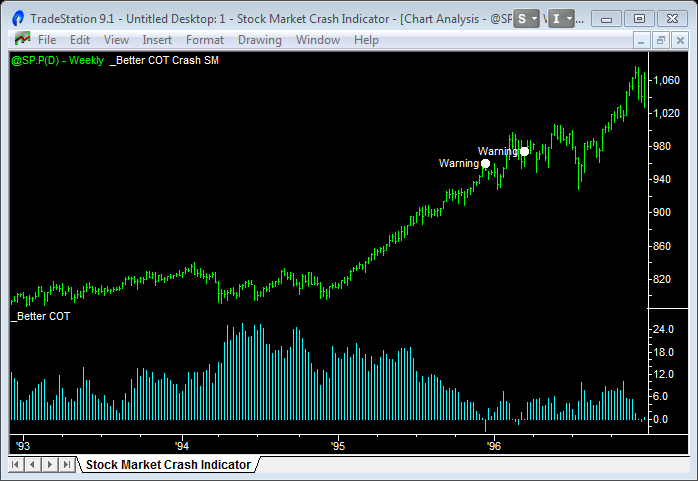

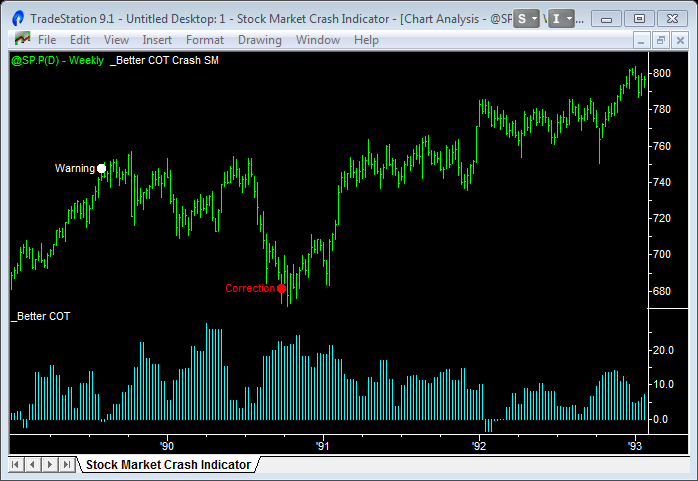

Well, here’s a simple indicator, using the weekly Commitment of Traders data, that has correctly signalled 10 of the last 10 market corrections and crashes – with only 5 false signals – since 1990.

And as I’m updating this article, in late March 2015, we’ve just had another crash warning signal go off. So let’s see how this one plays out.

Barry, Just a word … Thanks!! The analysis of COT was simply amazing … I’m very thankful I ran into your site and your indicators.

Geoffrey B.

Fasinating, Insightfull, Educational. Thank You!

John C.

But before we get to the indicator code, let’s check out the stats and charts.

The Stock Market Crash Indicator has pretty good stats

The indicator has signalled all 10 of the last corrections and crashes since 1990. The average delay between the signal and the market high is 5 weeks – but has been as high as 18 weeks. Most of the time there is a single indicator signal, but occasionally a double. And the indicator has only ever produced 5 false signals (some might count it as 6 though).

Certainly worth keeping track of.

The last Crash Warning Signal predicted the 2014 correction

Although this last correction was only 9.9% on the S&P500 futures, it was so close to the 10% technical definition of a correction that I’m going to count it. During this correction, the NASDAQ fell 10.7% and the Russell 14.4% – which shows the market sell-off was sizeable.

Having this successful signal re-confirmed the usefulness of this indicator to me, having had 3 false signals during 2013 and early 2014.

We had 3 false Signals during 2013 and early 2014

The crash warning signals during 2013 and early 2014 just never worked out. We had 3 in-a-row but the market was just too strong and the Commitment of Traders data quickly reversed and the uptrend continued. Maybe Fed intervention and continued Quantitative Easing just kept the market from behaving “normally” and correcting. Who knows.

And here are the Indicator signals since 1990

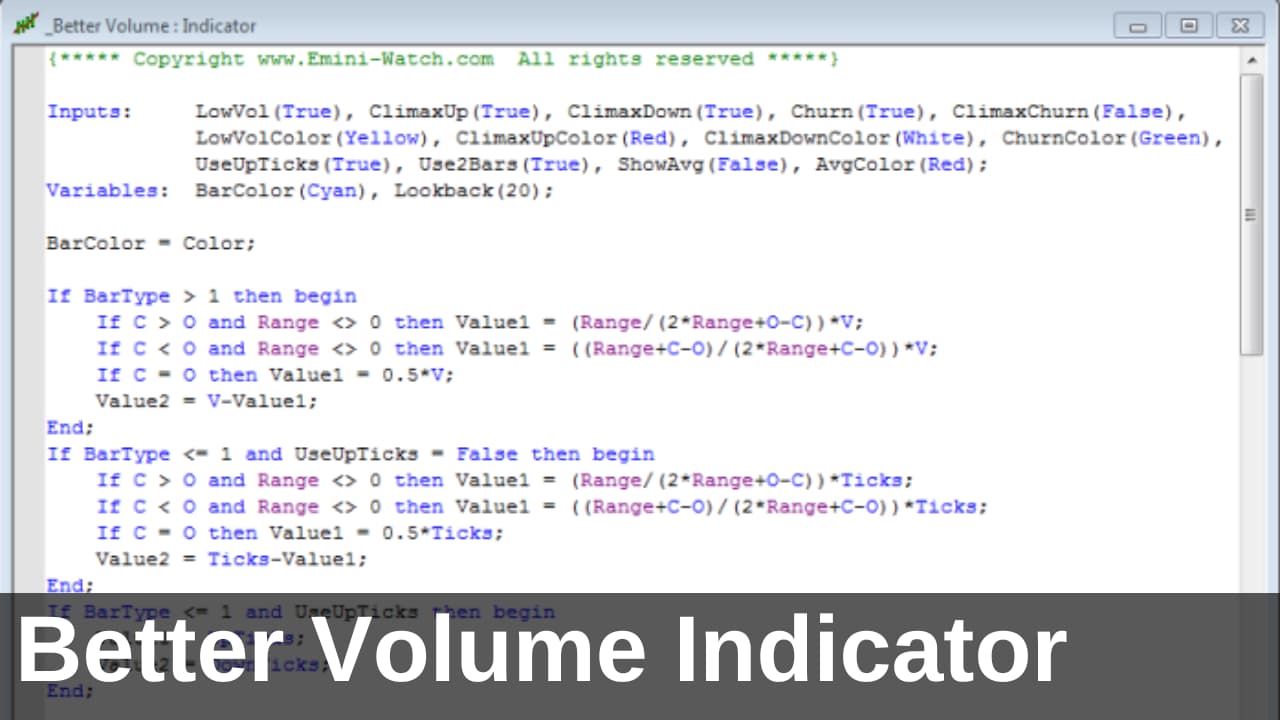

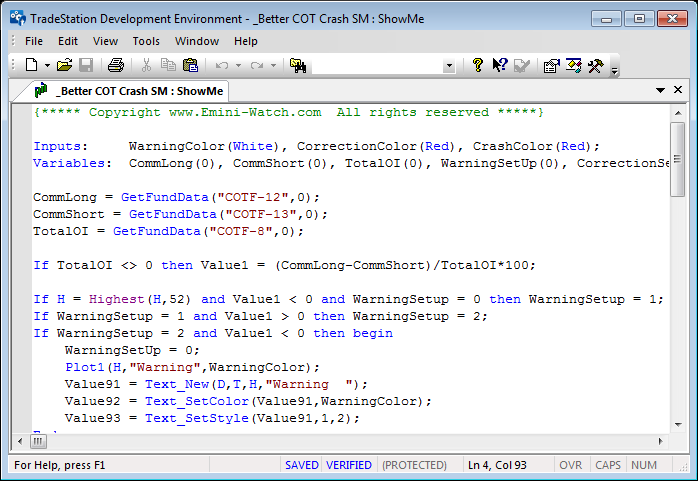

The Indicator code is essentially 3 lines

The setup for this Stock Market Crash Indicator goes like this:

- Professionals hedging as the market makes new 52 week highs, then

- They reduce their hedges as the market strength continues, until

- They end up with a net-Long position, and finally

- Start Shorting in anticipation of a stock market correction.

And a snippet of the indicator code in TradeStation EasyLanguage is shown above.

Please remember the caveat discussed in the video above: the indicator is based on the SP contract data which is becoming more and more thinly traded. Despite this, I’ll continue to track the progress of this remarkable Stock Market Crash Indicator.

Now, can the Bond market help forecast when the stock market will crash? Check out this Bond Market indicator: The Intermarket Oscillator

Stock Market Crash Indicator for TradeStation

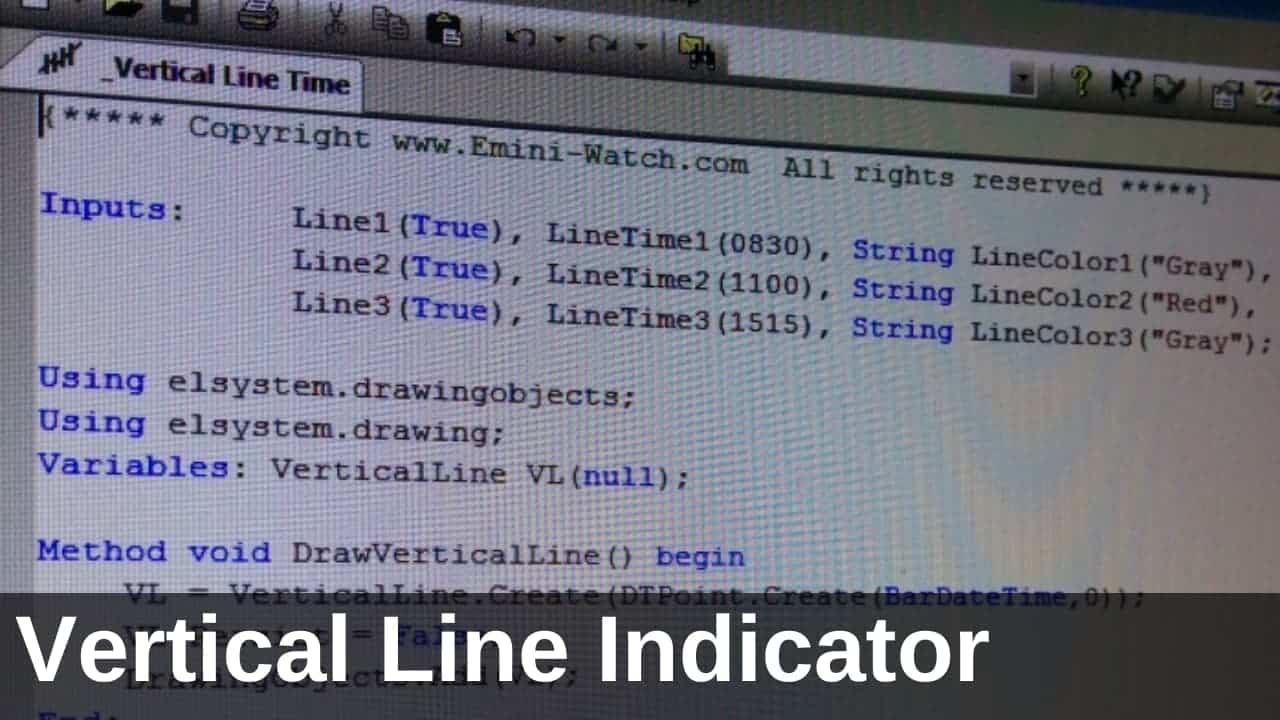

You can download the TradeStation EasyLanguage code in both .ELD and text formats below. Use the indicator on weekly charts of @SP.P to duplicate the signals. The indicator is provided free, so please, give credit if due and don’t expect support.