Do the ‘Better’ indicators work on Bitcoin? Well, yes and no.

And that’s the problem. Bitcoin data is all over the place and there is no single unified data feed. As of November 2020, there are (at least) 28 exchanges where Bitcoin trades. On the plus side, the activity is becoming more concentrated in fewer exchanges and arbitrageurs are forcing the “spreads” between exchanges lower.

But we are still left with a data problem 🙁

Table of Contents

Use the links above to jump to the Bitcoin Trading topics that interest you.

Symbols for Bitcoin, the Bitcoin Index and Bitcoin Futures

Here are the symbols (on TradeStation) for Bitcoin, the Bitcoin Index and Bitcoin Futures:

- Bitcoin symbol: BTCUSD

- Bitcoin Real-Time Index symbol: $BRTI

- Bitcoin Futures symbol: @BTC (continuous contract)

The BTCUSD data feed, listed under TradeStation’s Forex symbols, is the Coinbase Pro exchange (formerly GDAX) trading history (h/t Ritta Lisa). Coinbase Pro is the largest cryptocurrency exchange in the US and I find this real-time data feed the most useful.

Trading indicators are only as good as the data you feed them.

Emini-Watch.com

The Bitcoin Real-Time Index is the CME’s attempt at creating a unified Bitcoin data feed. They have taken the data feed from 5 major exchanges and aggregated them together to create $BRTI. However, this index does not include volume data, only the number of trades. The CME’s Bitcoin futures contract is then designed to be traded against this real-time index.

You can now trade Micro Bitcoin Futures

On 3 May 2021, the CME launched Micro Bitcoin Futures, which are tradable on the Globex electronic exchange. Trading hours are the same as Emini futures, and the symbol @MBT is used for the continuous contract. The big advantage is that the margin required to trade 1 Micro Bitcoin Futures contract is only $2,500 – but this can vary with Bitcoin volatility. The volume traded by Micro Bitcoin Futures is still very small, with less than 50,000 contracts per day. But to be fair, Bitcoin Futures are not trading in big volumes on Globex either (yet).

Volume Data for Bitcoin Charts

We need to make some adjustments to get volume data for each of these symbols – at least we have to in TradeStation! Each symbol needs a different “Format Symbol” setting:

- Bitcoin: 1440 minute bars and volume = Trade Volume

- Bitcoin Real-Time Index: 1440 minute bars and volume = Tick Count

- Bitcoin Futures: daily chart

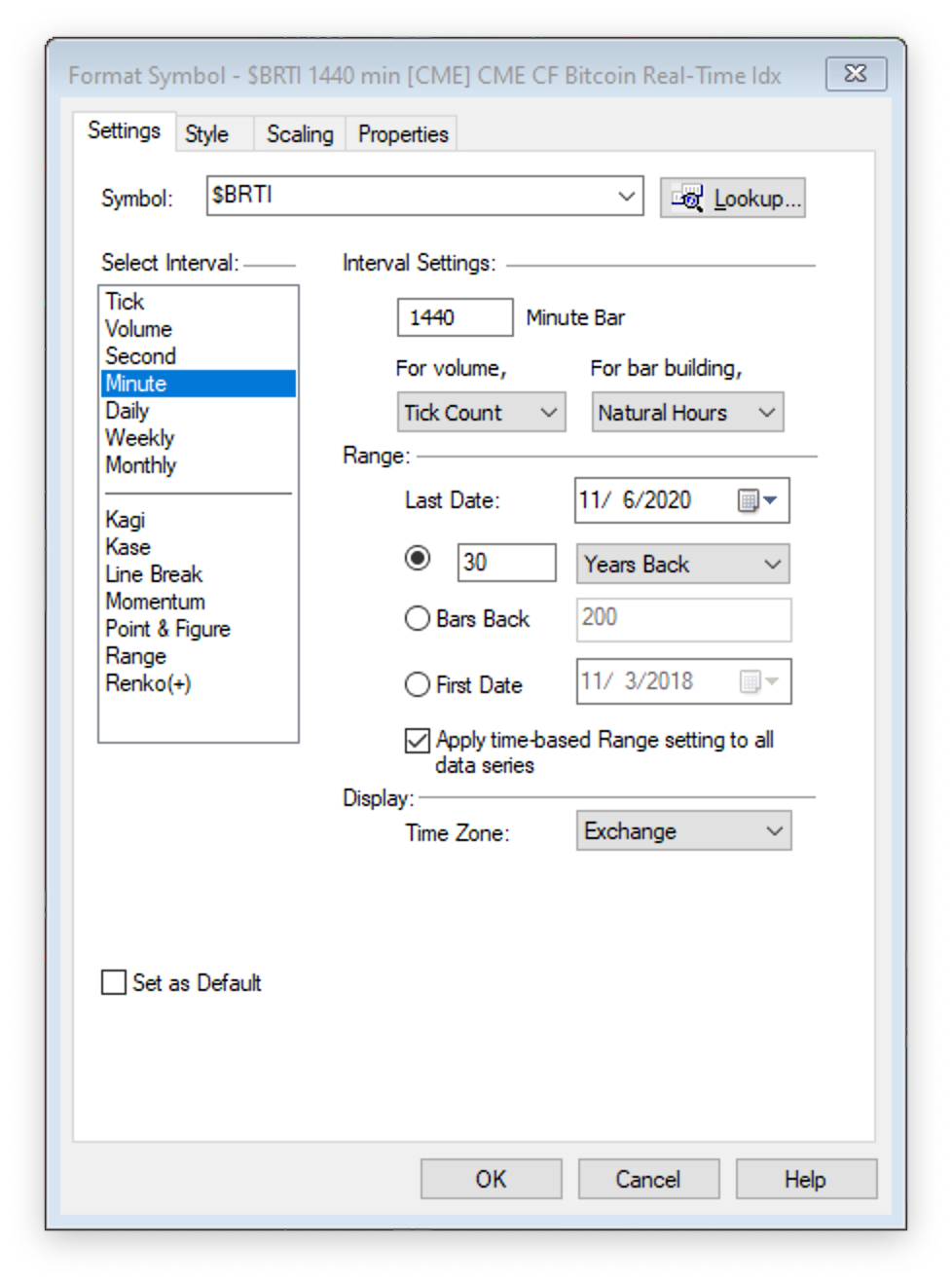

And here’s an image of what those TradeStation “Format Symbol” settings look like for the Bitcoin Real-Time Index ($BRTI).

That’s a 1440-minute chart with Tick Count used for volume. I’ve tested using Natural Hours or Session Hours for bar building and it doesn’t seem to matter which setting you use.

Session Settings for Bitcoin Charts

There are also some session settings you need to check. Bitcoin, unlike other tradable instruments like the Emini, trades 24/7. But for some reason, TradeStation has chosen to ignore the weekend trading of Bitcoin.

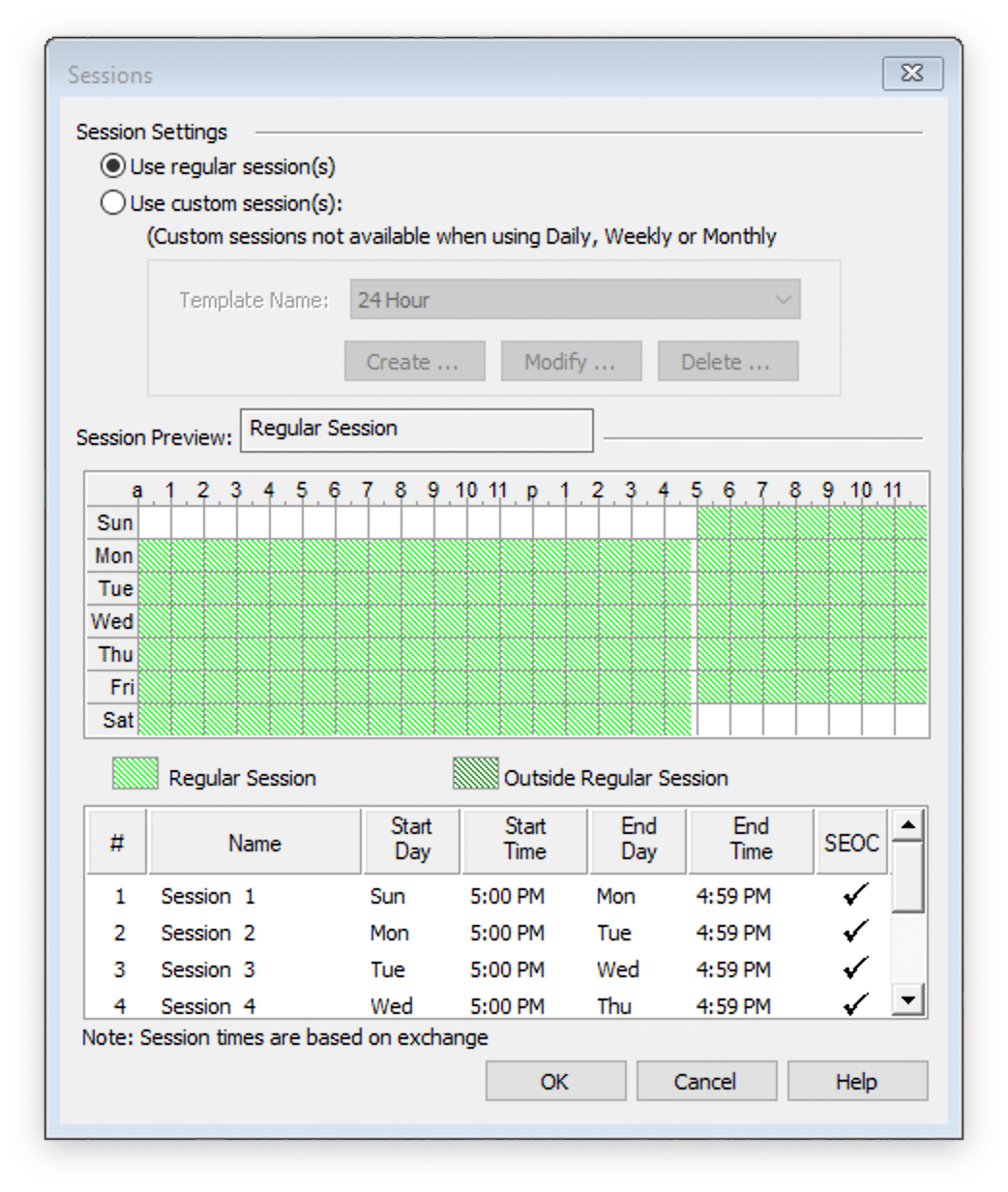

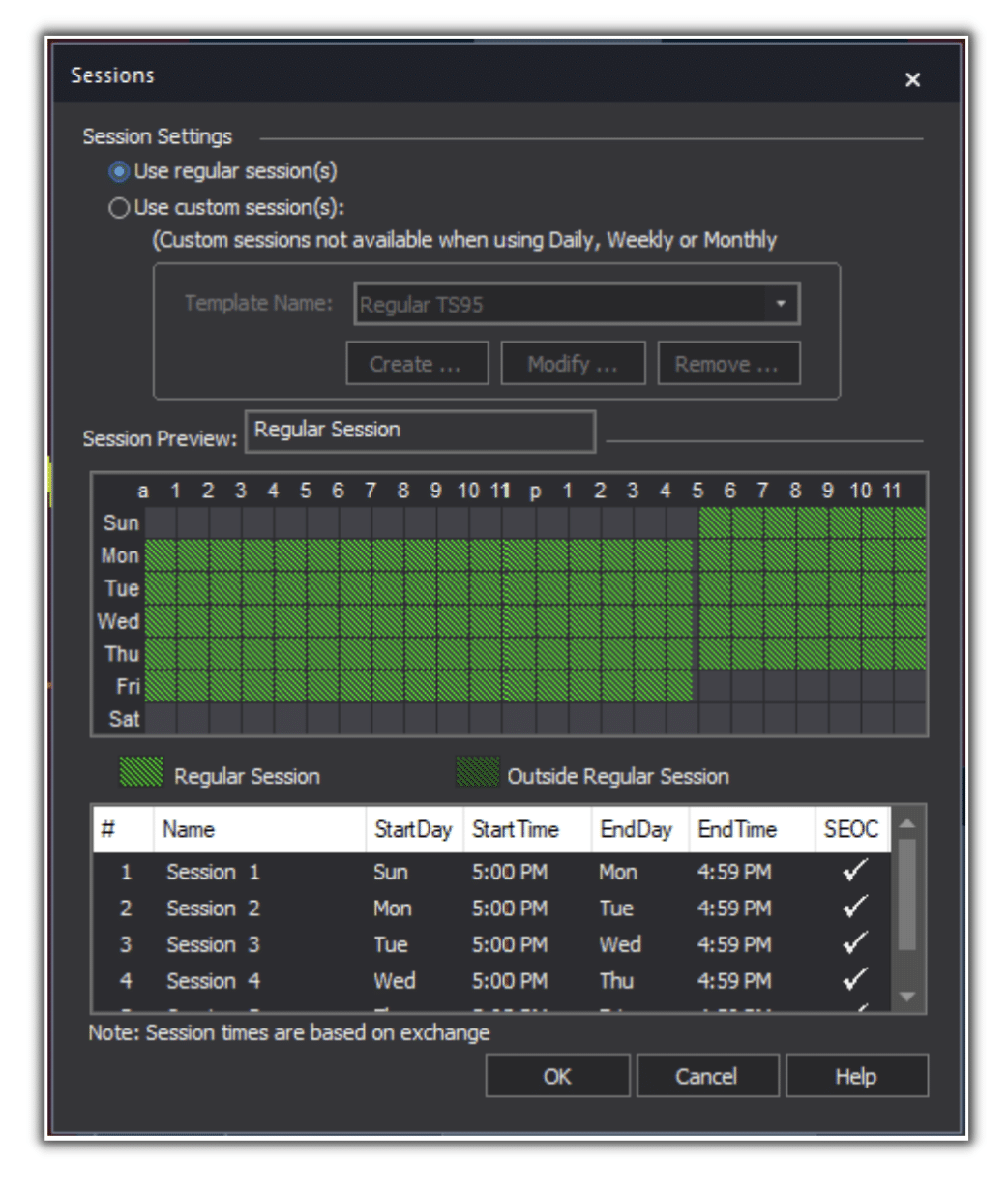

And what’s even stranger, they’ve also made the default session settings different between TradeStation 9.5 and TradeStation 10 (see images above). In TradeStation 9.5 the default session settings are almost 24 hours and 6 days a week; in TradeStation 10 the default session settings are almost 24 hours but 5 days a week.

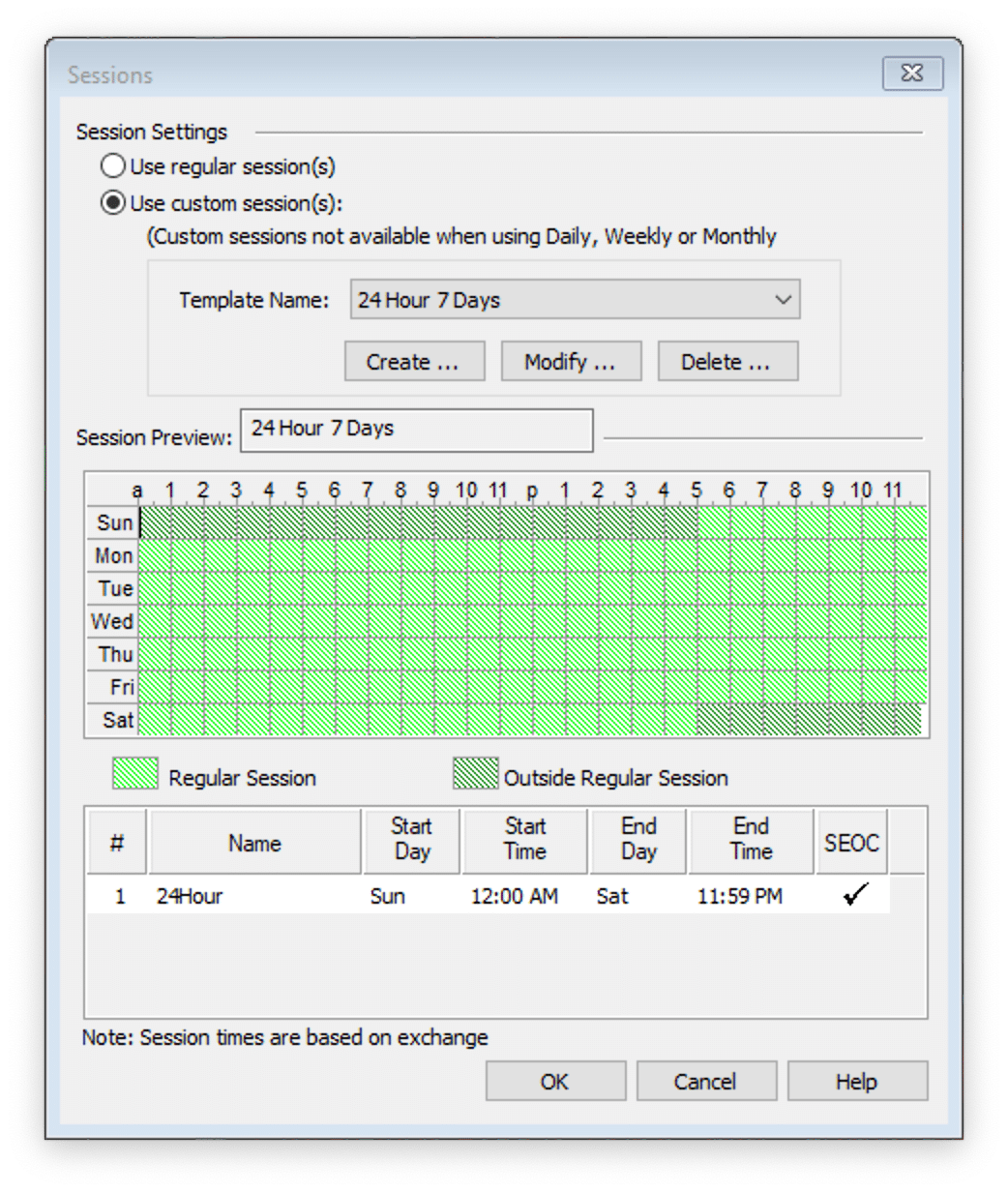

Since Bitcoin trades 24/7 I prefer to set up a “custom session” like the one shown in the image to the left. TradeStation session times for Bitcoin use the New York time zone as default.

And you’d be surprised how much trade (and price movement) happens from Saturday afternoon to Sunday afternoon. As they say, Bitcoin never sleeps!

The ‘Better’ Indicators for Bitcoin

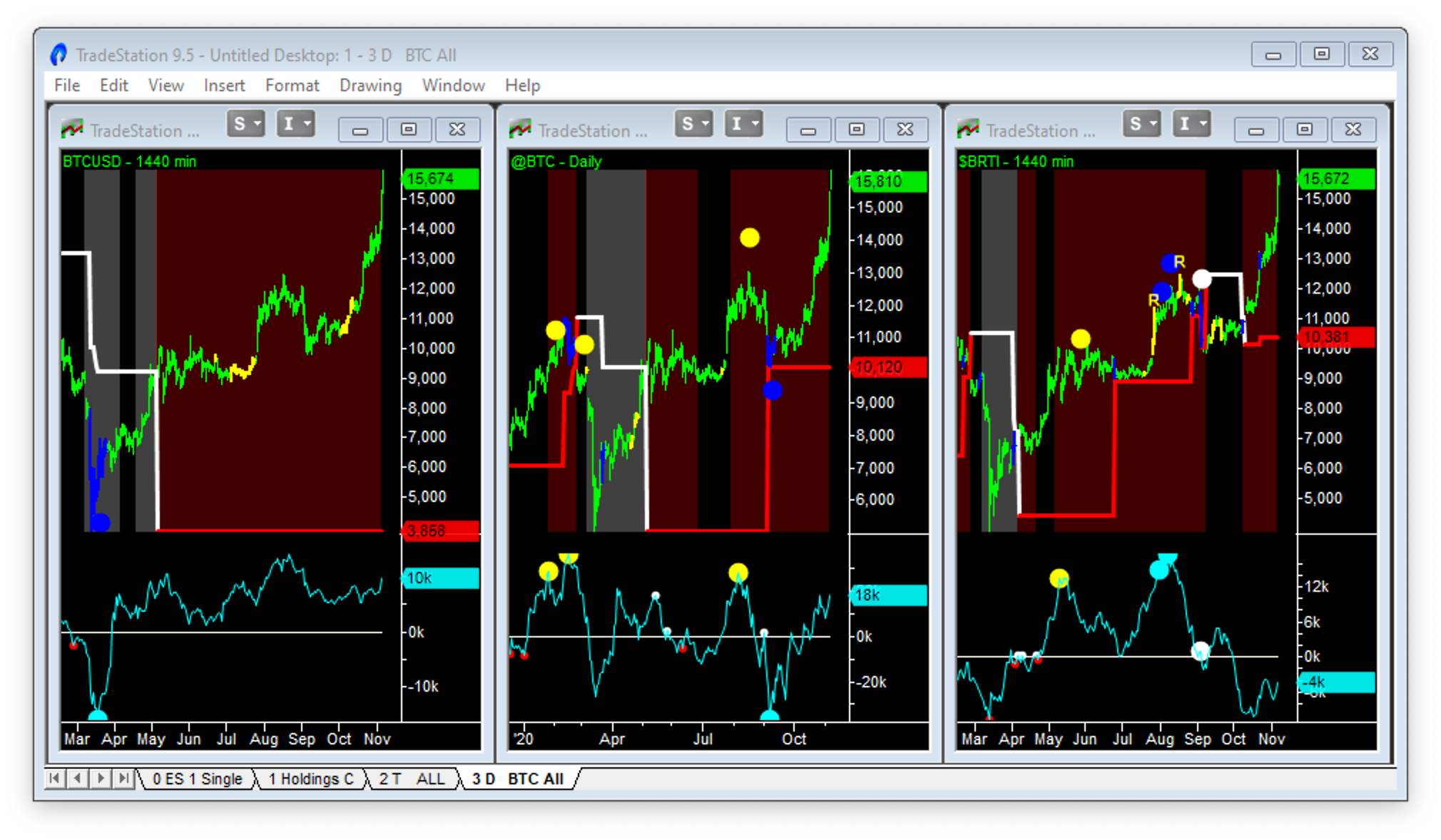

The ‘Better’ Indicators work on each of the Bitcoin symbols. But there are differences because each symbol has different volume data, which impacts the Better Momentum and Better Pro Am indicators. So here are the 3 charts side-by-side with Better Momentum below the price bars and Better Pro Am on the price bars themselves.

And as you can see there are significant differences between all 3 charts:

- The BTCUSD chart caught the March 2020 low with Exhaustion Volume and blue Professional bars forming a “V” reversal

- The @BTC chart caught the September 2020 take-off just above $10,000 again with Exhaustion Volume and blue Professional bars forming a “V” reversal, and

- The $BRTI chart caught the August “false” break-out that was being led by the Amateurs causing RAMBO patterns and unstable Exhaustion Volume

We would expect the Bitcoin price to be more similar between the different Bitcoin data feeds – and so the Better Sine Wave indicator signals should match. But remember that @BTC is a futures contract that trades at a premium to the cash market or index – often as much as $200!

So here are the 3 charts side-by-side with Better Sine Wave cycles below the price bars and Better Sine Wave support and resistance lines on the price bars themselves.

Again, there are differences between all 3 charts but maybe not as significant as the volume signals. Unfortunately, no one chart is ideal. So my recommendation, if you’re a Crypto trader, is to use all three Bitcoin data feeds and follow all three charts.

And Why I’m a Bitcoin “Hodler”

And if you’re unfamiliar with the term “Hodl” here’s a definition from Wikipedia:

Hodl is slang in the cryptocurrency community for holding the cryptocurrency rather than selling it. A person who does this is known as a Hodler. It originated in a December 2013 post on the Bitcoin Forum message board by an apparently inebriated user who posted with a typo in the subject: ‘I AM HODLING’.

I hope you found this article on Bitcoin and the ‘Better’ indicators helpful.