Structuring your trading business to significantly lower your tax bill is becoming increasingly difficult and risky.

Clarification – Tobin Tax

The Tobin Tax discussed in the video has NOT been introduced for Emini trading. The calculation shown illustrates the possible magnitude of such a tax on Emini trading.

Today’s video is a little off topic – and frankly a bit of a rant. In the last 2 years I’ve learned to accept the world in which I live, as well as the fact I can’t change it. So rather than “waste” energy railing against the system, for me the more pertinent question is:

“How should I adapt? What should I do?”

As far as tax goes, Governments have gotten themselves into a whole heap of trouble – and as a result taxes are going up and the net is tightening. They’re in such a tizzy, all their decisions are knee-jerk and pandering to their support bases.

It’s not an exact parallel, but it does remind me of the mess the recording industry got themselves into after music downloading became an epidemic. They decided to sue the downloading music lovers – the very people they’d been “ripping off” for decades. Instead of fixing their broken music delivery business model.

Then along comes Steve Jobs. Who understands. People don’t want to break the law, they want to pay the artist for their work, they just want to pay a reasonable amount and not be gouged with having to buy an album when all they want is a track. And illegal downloading ceases.

It’s the same with taxes. The complicated rules – classifying some money as income, some as corporate profits, some as dividends, some as capital gains, etc. Then with differential tax rates and deductions on each. All designed to favour different groups. The man on the street just knows he’s being ripped off and those in-the-know are getting a better deal.

And what Governments don’t get is that people want to pay taxes. They know the community in which they live doesn’t come for free. They just want one fair rate for everyone.

There I go again. Wishing for a world other than the one in which I live. It’s futile. Focus on the job at hand – how to adapt to the world in which I actually live. So just watch the video.

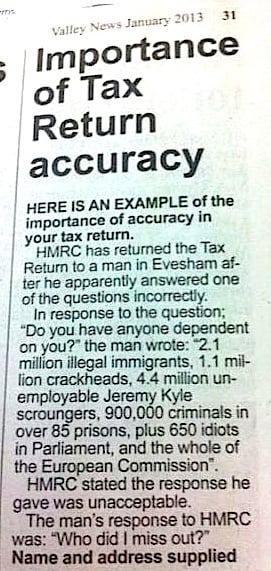

Many thanks to Jason S. for the UK newspaper clipping above. HMRC is the UK’s equivalent of the IRS, just FYI. And for more on the crackdown on “tax havens” in Europe, check out this video.

Update March 2015 – Puerto Rico, the new tax haven

Puerto Rico – a US territory – is in a fiscal mess. But rather than raise taxes and kill its economy, it has decided to encourage inward migration and business formation by dramatically reducing taxes for businesses and individuals. These developments are very interesting, particularly for US citizens who can be flexible in their business structuring.

Simon Black of Sovereign Man has done a great job of summarising the benefits and has also released a larger PDF report here.