Emini futures (or ES futures) are probably the most important trading vehicle in the world.

This article aims to be the ultimate introductory guide to Emini futures (and it has been updated for 2025). It includes answers to the most frequently asked questions, charts and data showing the importance of Emini futures and downloadable resources for Emini traders.

Table of Contents

Use the links above to jump to the Emini Futures topic that interests you.

If, after reading this article, you still have a question, get in touch, as I’d love to keep adding answers to your questions – and make this the most comprehensive Emini futures guide out there.

Please note

This article’s dollar ($) figures are in US dollars (US$).

What Are Emini Futures?

The Emini (or E-mini, ES, or Mini) is a futures contract that tracks the S&P 500 stock market index. It is traded on the Chicago Mercantile Exchange (CME) via its Globex electronic trading platform. The contract symbol is ES, and trading is 23 ½ hours daily, five days a week.

Emini contracts are available on various US stock market indices, commodities and forex currencies. However, when traders refer to Eminis or Eminis, they generally refer to the most important one: the futures contract that tracks the S&P 500 stock market index.

Emini futures were launched in September 1997 to attract non-professional investors to index futures trading. Previously, the only game in town had been the “large” (SP) contract, but it had become too expensive for the “little guy” to trade. So, the CME created the Emini contract, which was one-fifth the size of the “large” S&P 500 futures contract and required one-fifth the margin to trade.

Large Contract (SP) No Longer Trades

The large S&P 500 contract (SP) ceased trading on 30 September 2021. All S&P 500 index futures trading is now electronic through the Emini (ES) or the Micro Emini (MES). The Emini has also effectively replaced the old SP contract, with initial margins of between $12,000 for intraday positions and $17,000 for overnight positions.

The Emini became a huge success – not only with non-professional traders but with professionals, too. With this success, the CME (and other exchanges) decided to launch over 40 other “E-mini” and “E-micro” futures contracts over the next ten years, covering:

- S&P Midcap 400 (symbol EMD)

- S&P Smallcap 600 (symbol SMC)

- NASDAQ 100 (symbol NQ, 100 largest NASDAQ companies)

- NASDAQ Composite (symbol QN, all 3,000+ NASDAQ companies)

- NASDAQ Biotech (symbol BQ)

- Dow (symbol YM, traded on CBOT exchange)

- Russell 2000 (symbol TF, traded on NYBOT/ICE exchange, small-cap index, formerly ER2 on CME)

- Russell 1000 (symbol RF2, traded on NYBOT/ICE exchange, large-cap index, formerly RS on CME)

- Metals and commodities such as Copper, Gold, Silver, Corn, Wheat, Soybeans, Natural Gas, Crude Oil, Heating Oil and Unleaded Gasoline

- Forex rates versus the US Dollar, such as the Euro, British Pound, Swiss Franc, Japanese Yen, Australian Dollar, Canadian Dollar and Chinese Renminbi

However, none of these additional contracts was as successful in attracting traders and trading volume as the “original” S&P 500 Emini contract. Then, in 2019, the CME decided to change tack and launch the Micro Emini.

What Are Micro Emini Futures?

The Micro Emini futures contract is the same as the “regular” S&P 500 Emini contract in every respect, except it is 1/10th the size. Each 1-point move in the S&P 500 index is worth $5 per Micro Emini contract, compared to $50 for the Emini (ES). And the margin to trade a Micro Emini contract is also 1/10th the size.

Typically, you need a $12,000 margin to day trade a single Emini contract (Source: Interactive Brokers, January 2025). However, the Micro Emini only requires a $1,200 margin per contract. This should encourage new traders to try Emini trading and possibly attract Forex and Crypto day traders to switch.

The CME launched the new “Micro Emini” in May 2019 with four new contracts – one for each of the major US indices:

- Micro Emini S&P 500 (symbol MES)

- Micro Emini NASDAQ 100 (symbol MNQ)

- Micro Emini Dow (symbol MYM)

- Micro Emini Russell 2000 (symbol M2K)

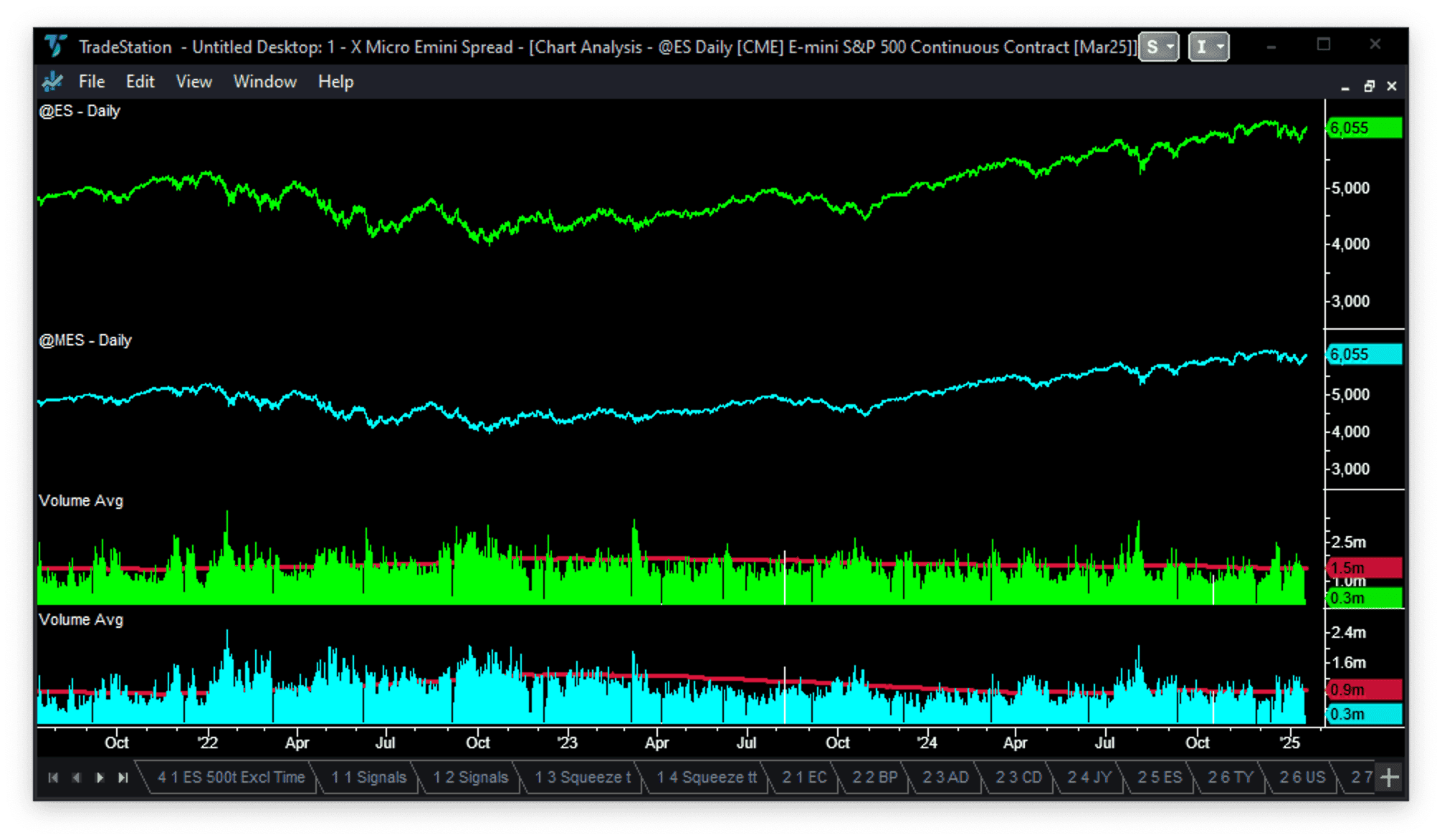

The chart below shows the trading of Micro Emini (MES) compared to the Emini (ES) from 2021 to 2024.

Price moves are virtually identical, with the spread contained to 0.25 points, except on rollover days or low-volume trading holiday periods. Volumes are increasing from an average of 250k contracts per day in mid-2019 to 900k contracts in 2024. When adjusted for the difference in margin, this is approximately 6% of the daily volume traded on the Emini (ES) – up from 2% in 2019.

Why Trade Emini Futures?

- Equally easy to go Long or Short: You buy or sell the current Emini contract, and there is no up-tick rule. If you traded the SPY ETF, you would have to buy or sell different ETFs (Long: SPY or leveraged SSO; Short: SH or leveraged SDS).

- 24-hour trading makes the Emini attractive to traders worldwide. One trading vehicle can play overnight moves in related equity markets, like the DAX or FTSE.

- Electronic trading platform: Your orders are entered instantly, and you are notified instantly when they are executed. Changing and cancelling orders is trivial—no phone call to your broker is required—and you know exactly where you stand every second you’re in a trade.

- Level playing field: The Globex electronic trading platform gives large and small traders equal access to the market. Trades are executed in the order they are received, and unlike pit-traded futures or equities, no games can be played.

- Tight bid/ask spreads: So much volume is traded through the Emini that the difference between the bid and the asking price is only 1 tick or 0.25 index points – the minimum.

- Large depth of market: Again, the Emini market is so liquid that there is plenty of volume on either side of the last traded price, allowing large orders to be filled with minimum slippage (or difference from the previous traded price).

- Volatile but not unmanageable: The Emini is active daily, giving the day trader plenty of opportunities to trade. Remember, a “sleepy” market is impossible to day trade. However, the Emini volatility is also manageable – except maybe around FOMC announcements – and is not driven by individual company news events.

- Low brokerage rates: Broker commissions for trading Eminis continue to fall. Interactive Brokers advertise a rate of $0.85 per contract per side (as of January 2025). This excludes exchange, clearing and regulatory fees, which make your “round trip” or “in-and-out” brokerage commission closer to $4.20 per trade. TradeStation’s advertised rate is $1.50 per contract per side, which includes using their excellent charting platform.

- Low margin requirement: To open a day trading position with Interactive Brokers, you need a margin of $12,000 per Emini contract (as of January 2025). If you hold the position overnight, this margin requirement increases to $17,000 per contract. TradeStation has much lower margin requirements for Emini day traders of $1,700 per contract, although overnight margin requirements match Interactive Brokers. Remember, these are absolute minimums – you should be trading with much more capital behind your positions – and these margin requirements move daily based on market volatility.

- Low minimum account size requirement: The brokerage business is so competitive that there is no minimum dollar amount to open a futures trading account with Interactive Brokers or TradeStation. But if you are an active stock trader you will be classified as a Pattern Day Trader and need to maintain a minimum account balance of $25,000.

- Lower tax rate than trading forex or stocks: Income from trading Emini futures is taxed at a “blended” rate of approximately 22% (60% capital gains taxed at 15% + 40% income taxed at your marginal rate, say 33%). Gains from trading stocks or cash forex are taxed at 33%. These comments apply to US tax residents; see below for more details.

- No trade-by-trade accounting: Another advantage of the tax treatment of Emini futures is that the tax reporting requirements are minimal. In particular, no trade-by-trade accounting is required; only the net profit for the whole year is needed.

Over the years, I have traded almost every possible security: stocks, options, commodities, futures, forex, mutual funds, IPOs, ETFs, cryptos, etc. But a few years ago, I finally found what I consider to be the ideal trading vehicle – the S&P 500 Emini futures. I trade it exclusively now and haven’t looked back since.

Emini vs Forex, Stocks and Options?

The section above lists a number of the advantages of Emini futures. But what about compared to trading forex, stocks, options, commodities or bonds? The video above was recorded a few years ago but still holds. Here are the main points:

- Forex: Forex trading is very popular but has one significant disadvantage. Volume data for forex is incomplete. There is no central forex exchange, and the banks dominating forex trading don’t share volume data in real-time. This makes it very difficult to track the average trade size and see where the Professionals are active.

- Stocks: Stock trading has two significant disadvantages. Although you could trade thousands of individual stocks, 50% to 80% of the time they track the overall market. Plus, you’re at the mercy of “event risk” – news announcements that suddenly cause prices to soar or dive.

- Options: Options trading is too complicated – you have to get the direction, the magnitude of the move, AND the timing right. Plus, there are a gazillion different strategies – bull call spreads, bull put spreads, butterflies, iron butterflies, straddles, strangles, collars, calendar spreads, etc. My head hurts just writing this.

- Commodities: Professionals dominate Commodity markets – if you trade something like Orange Juice, you’d better know your stuff (e.g. was there a frost in Florida overnight). Plus, they either have too much volatility or not enough. If you’ve ever been stuck in a lock limit up or lock limit down move, you’ll know what I mean by too much volatility.

- Bonds: Lastly, the granddaddy of them all. Big and old money trades the bonds – not many Amateurs try their luck. And frankly, they’re a little bit too sleepy for day trading.

Which Is the Best Emini Contract to Trade?

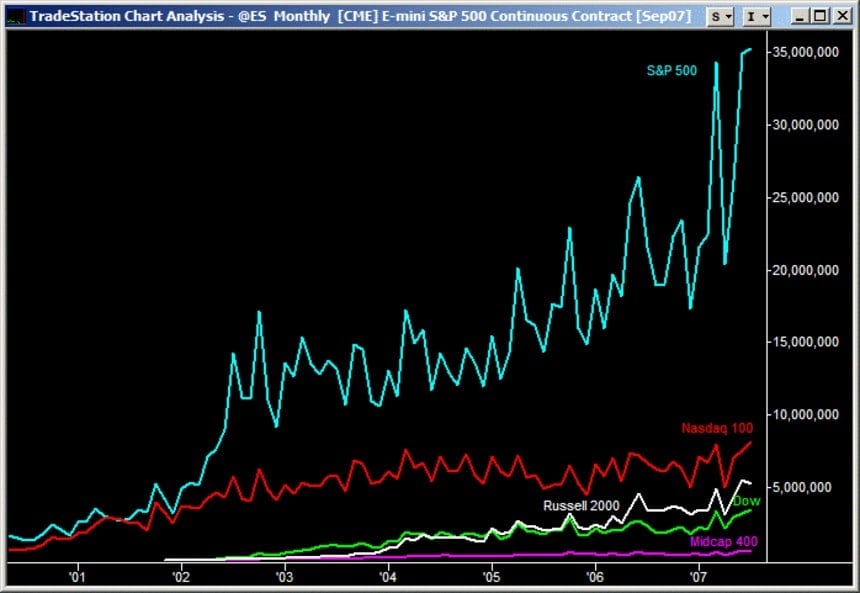

The chart above of monthly trading volumes shows that the S&P 500 Emini continues to dominate index futures. And of the 40+ “E-mini”, “E-micro”, and “Micro Emini” contracts, only 10 have daily trading volumes over 1,000 contracts. Given these statistics, I wouldn’t be surprised to see the number of “E-mini” and “E-micro” contracts rationalised in the future.

So, which Emini futures contract is the best to trade? IMHO, the S&P 500 Emini is best, but you could also consider:

- Micro Emini (symbol MES): The MES has become a big success over the last five years. This smaller contract (1/10th the size of the Emini) allows new traders to try Emini trading with much less capital – a $1,200 margin per contract, compared to $12,000 for an Emini contract.

- Dow (symbol YM): The YM was popular a few years ago. Traders liked the smoother/less volatile trend moves. However, the lower liquidity meant poorer fills and greater slippage. YM trading volumes are down these days, and the “hype” has come off a little.

- NASDAQ 100 (symbol NQ): Traders like the larger trend moves in the NQ, as the NASDAQ index has a higher beta than the S&P 500 index. As a result, NQ trading volumes are up and the NQ had a very good year in 2024.

On this website – and when traders talk to each other – the word Emini generally refers to the S&P 500 Emini futures contract.

How Big Is the Emini Market?

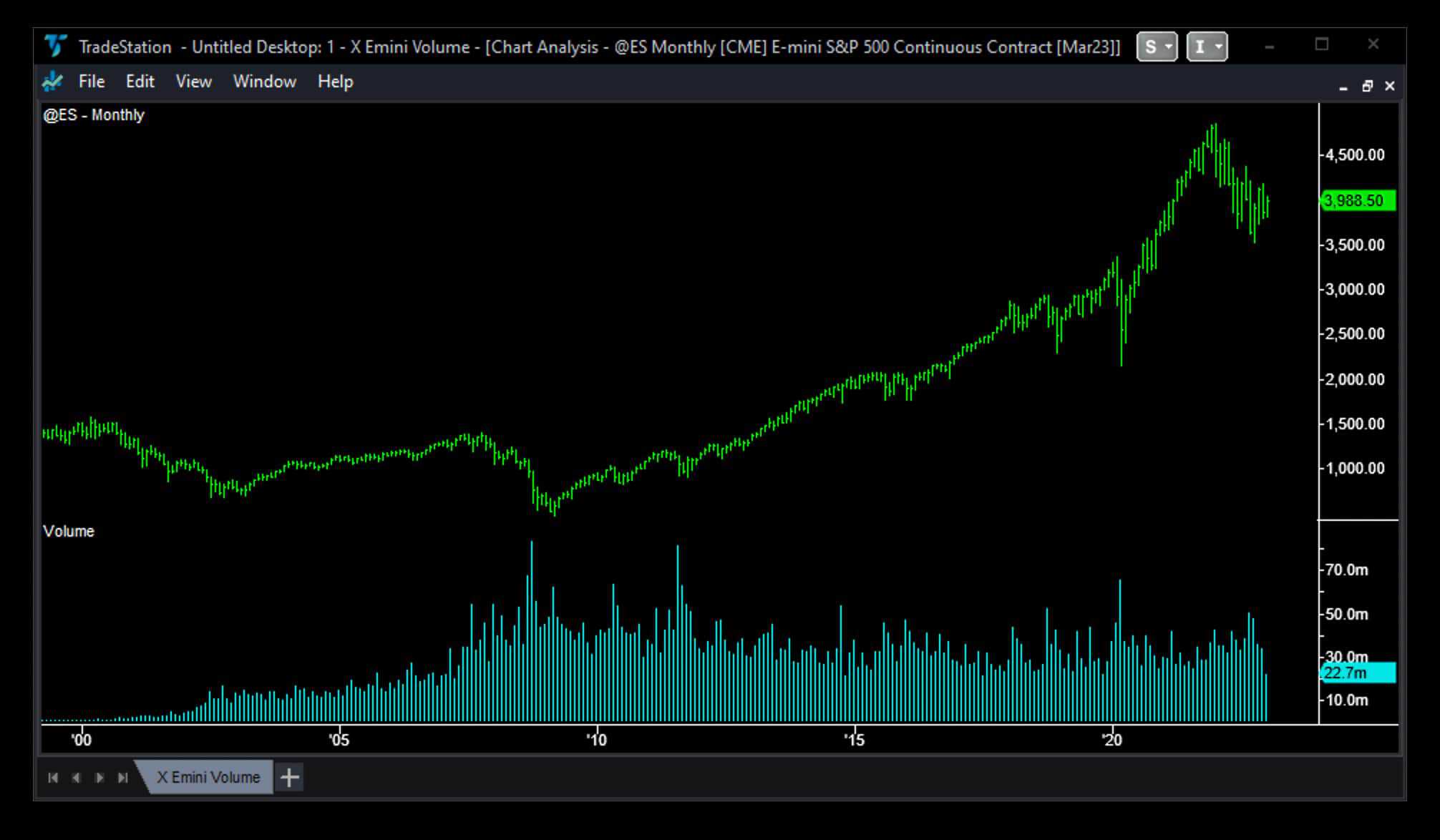

The chart above shows the growth in monthly Emini trading volumes. The volume spikes, with over 60 million contracts traded, occurred during large market sell-offs in 2008, 2011 and 2020. Trading volume has been steady since 2012, and the average daily trading volume is regularly over 1.2 million contracts.

So that puts the Emini in the world’s Top 3 Largest Traded Markets. Here are my estimates of the daily capital traded for each of these markets (as of a few years ago):

- SPY (S&P 500 Index ETF) = 65 m trades daily x $360 price = $23 bn in capital

- Euro/US Dollar (Spot Forex) = $78 bn total forex market x 24% Euro share = $19 bn in capital

- Emini (ES only) = 1.1 m trades daily x 2 parties x $8.5 k margin per contract = $19 bn in capital

The SPY ETF is the largest but it is more a position-taking market than a day trading vehicle, like the Emini.

Who Trades the Emini?

Everyone trades the Emini! Mutual funds, pension funds, hedge funds, insurance companies, high-frequency trading (HFT) firms, trading syndicates, professional traders and individual/non-professional traders.

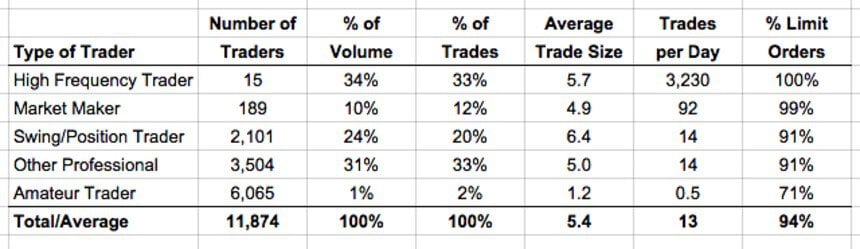

The chart above shows Emini trading volume by type of trader in 2010:

- 15 High-Frequency Trading (HFT) firms account for one-third of the total Emini market.

- 5,800 Professional traders (either day trading or position trading, i.e. holding overnight) account for the other two-thirds of the market.

- 6,000 Amateur traders (trading on average 1 contract per trade and 1 trade every other day) account for only 1% of the total Emini trading volume.

Source: “Findings Regarding the Market Events of 6 May 2010” Joint Report of CFTC & SEC, 30 Sept 2010, page 29.

Update – 36,000 Amateur Emini Traders

Nanex Research published more data points based on CFTC data that was used in a Harvard research paper. Between 17 September and 1 November 2010 there were 41,778 Emini trading accounts active. These included 30 HFT trading accounts, and these HFT firms accounted for 46.7% of the volume traded.

This means there are closer to 36,000 Amateur Emini traders – not 6,000 as previously estimated by the CFTC and SEC. You can read the full story here.

How Do Emini Futures Work?

The first thing you need is a futures brokerage account. This is different from a “normal” stock trading account – because different regulations govern it – but it works similarly. Interactive Brokers are an excellent option. I particularly like that they’re geared around being 100% online – for example, their application process is 100% electronic. But they’re not the only option.

Linking your brokerage account with your charting platform provider is a very cost-effective option. TradeStation and NinjaTrader, the leading charting platforms, now offer futures brokerage services.

The second thing you need is a charting platform and trading methodology. There are dozens of different charting platforms (I’ve reviewed the major options here) and hundreds, if not thousands, of different trading methodologies (here’s how I trade).

Let’s assume you’re following the Emini market on your charting platform and that your trading methodology has given you a signal to buy – or “go Long” – the market.

At this stage, you might have funded your futures brokerage account and have some initial capital you want to trade. Or you might be “paper trading” and using the trading simulator functionality of your broker to place trades. Either way, you enter a Buy order in your broker’s order entry screen – choosing an “at market” order (which will get you in straight away at the “ask” price) or a “limit” order (which will get you in when your order at the price you’ve nominated gets hit) of the current Emini futures contract.

The number of contracts you place an order for will depend on the size of your account, your broker’s margin requirements and your risk tolerance. You should immediately place your profit target and stop loss orders (each around 10 points in today’s market).

How much is an Emini tick?

Each 1-point move in the S&P 500 index is worth $50 per Emini contract. The minimum move of the Emini futures contract (or tick size) is 0.25 index points. So, 1 tick in the Emini is worth $12.50 ($50 x 0.25).

Assuming you got the trend direction right, your profit target will be hit, and you will make 10 points profit, less brokerage commissions. 10 Emini points equals $500 per contract traded. Brokerage commissions are approximately $4 per contract traded, so your net profit is $496 per contract. If you have a $40,000 account, you might be trading 2 Emini contracts, so your net profit would be $992:

((10 x $50) – $4) x 2 = $992

If you got the trend direction wrong, your stop loss order would be hit, and your loss would be $1,008:

((10 x -$50) – $4) x 2 = -$1,008

Once you’re out of the trade, cancel any outstanding orders. If your profit target got hit, make sure your stop loss order is cancelled. If your stop loss got hit, ensure your profit target order is cancelled. At the end of the day, your broker should email you a statement with any trades taken during the day – check the statement to confirm your daily net profit/loss and make sure you’re “flat” (i.e. not holding any outstanding positions).

What Margin Is Required to Trade the Emini?

The answer to this question depends on the futures broker you trade through. And 3 different $ amounts matter:

- Intraday Initial Margin: The amount you need to place an Emini day trading order in your account. Depending on your broker and current market volatility, it varies between approximately $1,300 and $12,000.

- Overnight Initial Margin: The amount you need in your account to place an Emini trade during the overnight or after-hours session. This varies but is approx. $17,000, again depending on your broker and current market volatility.

- Minimum to Open Account: The amount you need to open a futures trading account. Varies between $1 and $10,000, depending on your broker.

When they start, most traders want to know the minimum capital they need to start day trading. Although the ‘Intraday Initial Margin’ amount might only be $1,300, the minimum is the amount you are likely to draw down before becoming consistently profitable.

But rather than jumping in immediately and opening an account to day trade futures, you’re much better off paper trading or trading on a simulator account first.

Not got enough capital? Try trading Micro Emini Futures

The margin to trade a Micro Emini contract is only around $1,200 per contract. So you could start paper trading, then move on to trading Micro Emini Futures and finally graduate to trading the “full” Emini contract.

How Is Emini Day Trading Taxed?

Emini futures are taxed at an attractive tax rate – a “blended” rate of 60% of your (lower) long-term capital gains rate + 40% of your (higher) ordinary income tax rate. For most traders, this equates to a rate of between 19% and 22%. The actual tax rate you pay will depend on your total income.

On the other hand, if you trade stocks or forex, your short-term capital gains are taxed as ordinary income, which for most traders is between 25% and 33%. You only pay the (lower) long-term capital gains rate if you hold stocks for over a year.

Your tax rate for trading Emini futures will depend on your total income and resulting (marginal) tax bracket. For example:

- Total income less than $100k: 60% at a long-term capital gains rate of 15% + 40% at the ordinary income tax rate of 25% = 19% tax rate.

- Total income $100k to $200k: 60% at long-term capital gains rate of 15% + 40% at the ordinary income tax rate of 28% = 20.2% tax rate.

- Total income $200k to $400k: 60% at long-term capital gains rate of 15% + 40% at the ordinary income tax rate of 33% = 22.2% tax rate.

In addition, Emini traders have a much easier time doing their taxes at year’s end. Stock traders have to report every trade they make – Emini traders only have to report their annual net profits. Your broker will send you an IRS form 1099-B at year-end, and you transfer this one number (IRC Section 1256 contracts) to IRS form 6781 in your income tax return. If you hold any futures position over the year end cut-off, your broker will automatically mark it to market and calculate the realized plus un-realized profits.

Lastly, Emini futures trading losses can be “carried back.” This means any trading losses you incur in this current year can be used to get a tax refund on taxes paid on profits made in a previous year. You can apply this “carryback” to trading profits for the last three years by filing IRS form 1040-X or form 1045. Any trading losses you do not “carry back” can be “carried forward” indefinitely.

This Is Not Tax Advice

The comments above apply to US tax residents. They are estimates and should NOT be considered tax advice. Remember always to consult your own tax professional or accountant.

What Is the Emini Futures Symbol?

The Emini futures symbol is ES, and each contract is denoted by ES plus a code for the expiration month and year. Emini futures expire quarterly in March, June, September and December, and they are denoted by the letters “H,” “M,” “U,” and “Z,” respectively. So, ES25H (or ESH25) is the contract symbol for an Emini S&P 500 futures contract that expires in March 2025.

Here are the Emini futures symbols for 2025:

- March 2025 contract: ES25H (or ESH25)

- June 2025 contract: ES25M (or ESM25)

- September 2025 contract: ES25U (or ESU25)

- December 2025 contract: ES25Z (or ESZ25)

You can also chart a “continuous” contract on most charting platforms to make things easier. Data providers join together (or concatenate) symbols from adjoining quarters so you can plot the long history of each contract. In TradeStation, the continuous Emini futures contract has a symbol of @ES.

Update your chart data on Rollover day

On Rollover day, historical data on “continuous” contracts is adjusted for the new contract. So don’t forget to refresh all your “continuous” contract data. In TradeStation, you can either use Ctrl+R on an individual chart or shut down all your charts and re-start TradeStation. And that will re-load all the corrected back-history data.

When Do Emini Contracts Rollover and Expire in 2025?

Emini contracts “rollover” (to the next active contract) and then “expire” every quarter.

Contract expiry is on the third Friday of March, June, September and December. However, contract rollover – when most trading moves to the next contract – is the far more important date.

Contract rollover is now on the Monday before expiration, the third Friday of the expiration month. Before 2023, contract rollover was on the second Thursday of the expiration month unless the rollover month started on a Friday, in which case it was on the first Thursday of the month.

Contract rollover is more critical than contract expiry because most trading moves from the old contract to the new (or “front”) contract. Here are the Emini futures contract rollover dates for 2025:

- Monday 16 December 2024: Rollover to the March 2025 contract

- Monday 17 March 2025: Rollover to the June 2025 contract

- Monday 16 June 2025: Rollover to the September 2025 contract

- Monday 15 September 2025: Rollover to the December 2025 contract

- Monday 15 December 2025: Rollover to the March 2026 contract

Note: Forex futures traded on the CME Globex platform (i.e. EC, JY, etc.) usually roll over on the Monday before the Emini stock index futures (i.e. ES) roll.

However, on Rollover day, most trading volume is still on the “old” contract—traders don’t move to the “new” contract until the next day. So, I recommend you adjust your charts on Rollover day to show the “old” contract and take your signals on that. Alternatively, don’t trade on Rollover day at all; you’ll only miss four trade days a year by doing that.

Emini futures do “settle” at the end of each quarter, but most traders have liquidated their positions in the “old” contract and moved on to the “new” contract. Suppose you happen to be holding an Emini futures position at settlement time. In that case, your trading account is credited any profit (or debited any loss) on that contract, and your position is closed out. Unlike commodity futures like Copper or Crude Oil, physical delivery on settlement doesn’t exist for financial futures contracts like the Emini.

What Are Emini Futures Trading Hours?

Emini futures trading hours are almost 24/5. Weekly trading of the Emini opens on Sunday at 5 pm (CST) and closes on Friday at 4 pm. Trading is nearly 24 hours a day, with a break every day between 4 pm and 5 pm for scheduled maintenance.

Trade is broken into two sessions, the Day session and the After-hours session:

- Day session trading starts at 8:30 am and finishes at 3:15 pm (CST)

- After-hours trading starts at 3:15 pm, stops for an hour between 4 pm and 5 pm and then resumes until the open of the following Day session at 8:30 am

The greatest activity and volume traded occur during the Day session. However, data releases before the Day session opens can often generate large activity, as can any important news from Asia or Europe.

CME Eliminates 3:15 pm Market Pause – June 2021

Starting 27 June 2021, the CME decided to eliminate the 15-minute market pause that used to come at the Close of Emini trading, between 3:15 pm and 3:30 pm. Emini trading now continues until the daily maintenance shutdown at 4 pm. Luckily TradeStation has decided to still call 3:15 pm the official Close of the day session – so backtesting of historic @ES.D data is consistent. More details are in this video.

Emini Futures Trading Calendar 2025

The Emini follows the regular stock market holidays. Here is the Emini futures holiday schedule for 2025:

- Monday 20 January 2025: Martin Luther King Jr Day

- Monday 17 February 2025: President’s Day

- Friday 18 April 2025: Good Friday

- Monday 26 May 2025: Memorial Day

- Thursday 19 June 2025: Juneteenth Day

- Friday 4 July 2025: Independence Day

- Monday 1 September 2025: Labor Day

- Thursday 27 November 2025: Thanksgiving Day

- Thursday 25 December 2025: Christmas Day

- Thursday 1 January 2026: New Year’s Day

You can find the exact holiday trading hours and Open and Close times on the CME Group website here. Here is the Emini-Watch public calendar with important Emini trading dates:

If you use Google Calendar, just hit the “+” button (bottom right on the calendar below) and it will import this Emini trading calendar into your personal Google Calendar. The calendar can also be imported into other calendar applications using these links: iCal format and HTML format.

I hope you found this feature article on S&P 500 Emini futures helpful.