This is how I use the ‘Better’ indicators to day trade Emini futures for a living. In this video and article I summarize what I’ve learned and what works for me.

You need to become your own trader

No two traders are alike. No two traders have the same psychology, risk tolerance, trading capital, aptitude, dedication or interests. What works for me might not work for you.

If you want to be a full-time trader you need to develop your own trading methodology. Rules that suit your personality and circumstances. Then work on your trading every day, slowly making fewer mistakes and becoming consistently profitable.

Use this website and the trading videos for ideas and seeing a non-conventional approach to Emini day trading in action. Then as Bruce Lee says:

Absorb what is useful, discard what is useless & add what is uniquely your own.

Bruce Lee

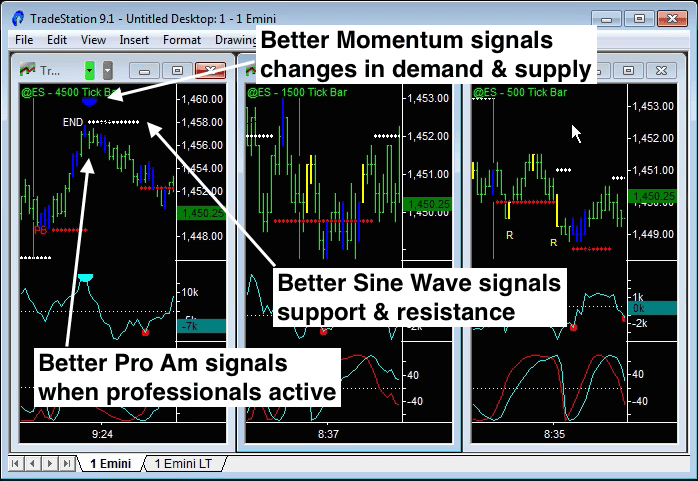

3 Non-correlated indicators produces better signals

All my charts, whatever time frame, have the same 3 non-correlated indicators:

- Better Sine Wave – analyses price and plots support and resistance

- Better Momentum – measures demand and supply volume

- Better Pro Am – uses trade size to spot professionals and amateurs

Better Sine Wave is plotted in the lowest pane of the chart and shows where the cycle measuring algorithm expects cyclical turning points. Confirmed cyclical support and resistance levels are then plotted on the price bars themselves as dotted horizontal lines. When the Emini breaks into a trend the “Pull Back” (PB) and “End of Trend” (END) warning signals are automatically printed on the chart.

Better Momentum is plotted below the price bars and shows the waves of buying and selling volume. Exhaustion volume is show with large cyan dots and bullish/bearish divergence patterns are marked with small red/white dots. The most important of these divergence patterns are also plotted on the price bars themselves.

Better Pro Am plots Professional and Amateur activity with blue and yellow PaintBars. I’m watching to see who is active at price extremes. If I see Professionals (blue bars) making new highs I know they’re taking profits and reversing positions. If I see Amateurs (yellow bars) making new lows I know they’re trading a breakout that is likely to fail and reverse.

For my Emini day trading, I use these 3 indicators on multiple time frames: 500, 1,500 and 4,500 tick charts. The charts include after hours data and the Emini symbol I use in TradeStation is @ES. Each higher time frame is 3 times the lower time frame. So the 4,500 tick chart is 9 times (3 x 3) larger than the 500 tick starting point.

Follow this link to a feature article about the advantages of Tick Charts.

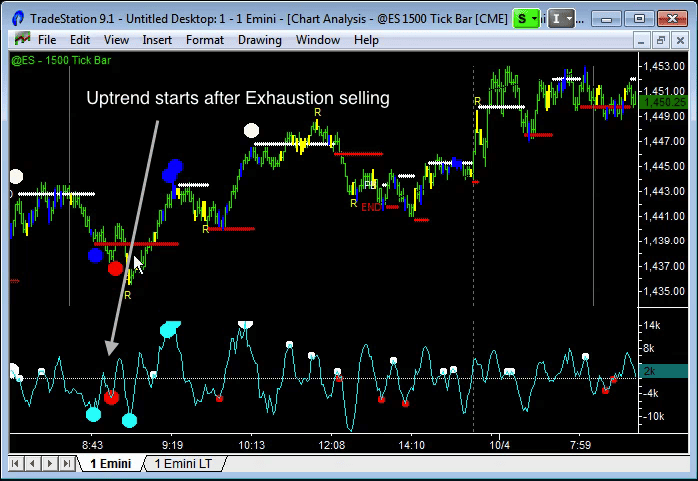

And exhaustion buying/selling to determine trend direction

Getting the trend direction right is critical. If you get the trend direction right, you can still make a lot of mistakes (like a poor entry) and still be OK.

But if you get the trend direction wrong, making a profitable trade will seem like hard work, stressful and take forever. If you’ve nailed the trend direction, winning trades come quickly, you take minimum “heat” (market going against your entry point) and it feels like you’re in the zone.

I use Exhaustion buying and selling volume signals from the Better Momentum indicator in my intermediate time frame chart (1,500 tick) to determine trend direction. To confirm a change in trend I look for 3 things:

- Exhaustion volume followed by divergence signals on the Better Momentum indicator

- “End of Trend” signals from the Better Sine Wave indicator, and

- Professionals active at price extremes (blue bars on Better Pro Am indicator)

My 3 non-correlated indicators are all confirming the same thing by analyzing different information – price, volume and trade size. This gives me high confidence that a trend change is approaching and an Emini day trade signal is setting up. Then use the lowest time frame chart (500 tick) to pick the entry point.

Trends always last longer than you expect and you won’t see a trend reversal until all the Amateurs are on the wrong side of the trade and the Professionals have gotten out and reversed – and this process takes a while to complete. So be patient.

I use TradeStation for charting and IB for order entry

I’ve used TradeStation since the very beginning – when they were called Omega Research and had a great little charting package called SuperCharts. These days TradeStation is still the best choice for me – particularly because their data feed is in-built and simplifies life considerably.

For some reason people think of TradeStation as a professionals-only platform. I don’t know why – it’s very simple to use and incredibly robust. Two important considerations.

Although I use TradeStation for charting, I do not use them as my broker. Instead I use Interactive Brokers and their Trader Workstation application for order entry.

I have the platform setup with “hotkeys” to buy or sell at market, then automatically enter profit target and stop loss orders. These are linked orders so when either one is triggered the other is automatically canceled (“one cancels all” or OCA).

The entry and exit orders are for 100% of my position, as I don’t scale in or out of Emini day trades. I find the Emini too volatile to use trailing stops to capture the size of swings I’m looking for. Instead I try to use the Emini’s volatility to hit my profit target, get out and wait for another setup.

The “hotkey” solution to order entry has reduced my stress Emini day trading enormously. As soon as I get an entry signal I hit “B” or “S” on my keyboard and I’m filled. I no longer worry about getting a good fill and the exit orders are sitting there, server-side. Internet connections do go down and this solution is the best I’ve found.

And follow rules to manage risk and win the mental game

I find trading stressful, even after all these years. The Emini market is just like the Colosseum in Rome – the pinnacle of the trading arenas. You’re up against the best of the best. Each day I fight and each day I want to survive – I don’t want to be a hero.

To maximize my chances of success I follow these rules:

- Trade 1 market – be a specialist, not a generalist

- No distractions – you only need 1 screen to trade

- Focus 100% for the first 60 minutes of the trading day

- If the market is slow, stop trading and do something else

- Choose a small target (4 points) to make each day, then stop trading

- Use a stop of 4 points, the Emini is too volatile for tight stops

- Stop after being stopped out 2 times, 4 point target made or after 6 trades

Some people think that at 4 points my stop loss is way too large and I’m taking too much risk. But the Emini market is volatile and you see the Professionals gunning stops all the time. I trade 1 Emini contract for every US$8k of equity and so my stop loss of 4 points corresponds to a 2.5% risk (4x$50/$8,000 = 2.5%) – quite reasonable. And I never move my stop loss.

Your website has provided me with a blueprint for how to manage risk, implement a rule-based trading system and removed the daily emotion which used to cause me great stress.

Ashley P.

I hope this video and article on How I Day Trade was helpful to you. Good luck with your Emini day trading.